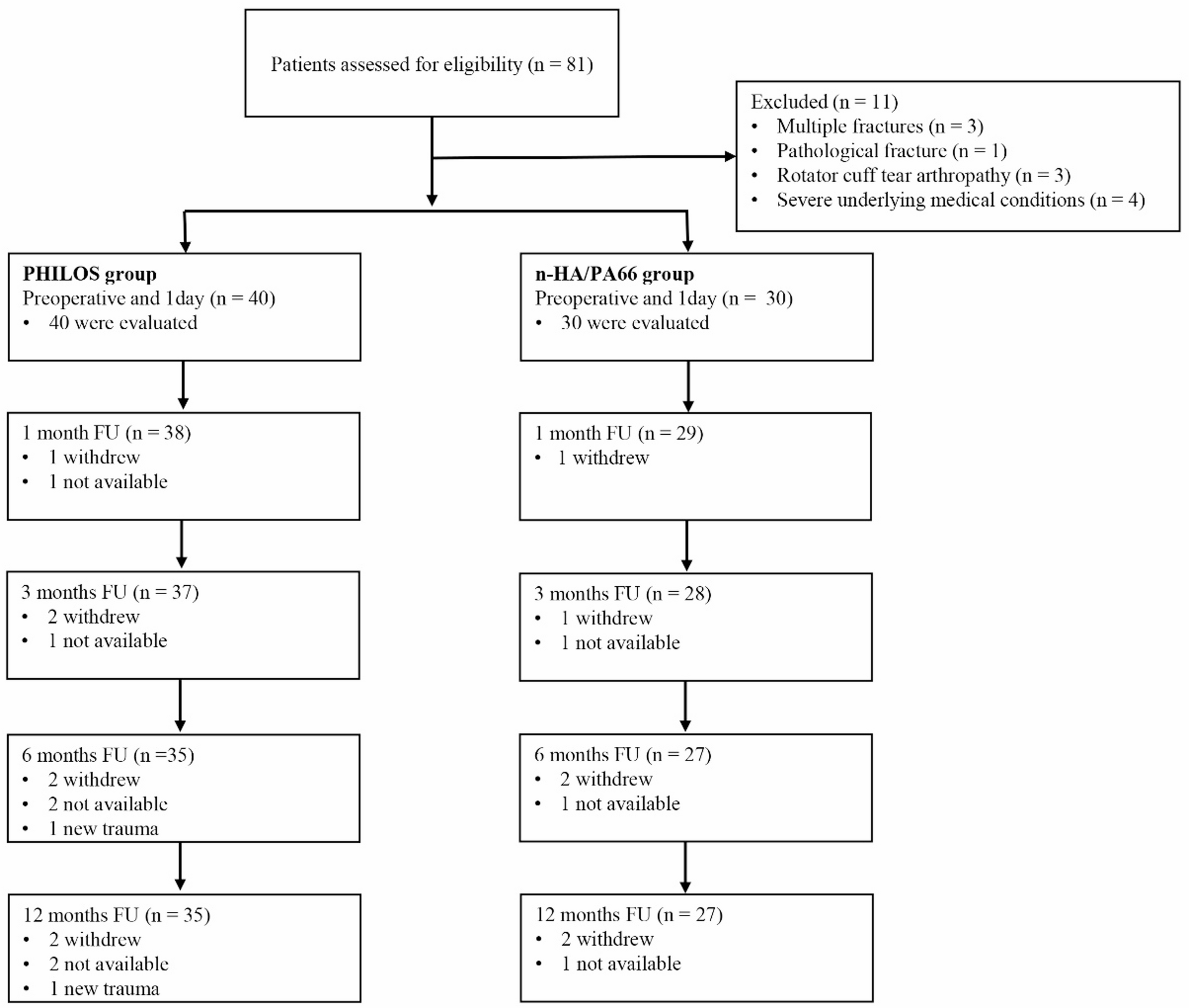

This study retrospectively compared the clinical outcomes of 62 elderly patients with Neer three- or four-part proximal humeral fractures who underwent PHILOS plate fixation, with or without the adjunctive use of a bionic n-HA/PA66 composite for medial support.

Elderly patients who present with Neer three- or four-part proximal humerus fractures frequently exhibit significant comminution and severe osteoporosis, which can substantially complicate fracture reduction and fixation during surgical intervention [23]. A key difficulty in the surgical management of these fractures lies in obtaining precise reduction and strong fixation, with accurate reduction of the humeral head being paramount. Furthermore, the importance of a stable calcar to prevent secondary varus displacement, particularly in distracted varus-type fractures, is well-established [9, 10, 24, 25]. This study presents an innovative application of n-HA/PA66 for medial calcar support. After a one-year follow-up, the n-HA/PA66 group exhibited significantly smaller changes in NSA (3.6° ± 1.6°) and HHH (2.4 mm ± 0.7 mm) compared to the PHILOS group, which showed changes of 9.5° ± 2.0° and 4.1 mm ± 0.6 mm, respectively, indicating superior clinical outcomes. This advantage likely stems from the critical role of optimal reduction and minimized postoperative displacement in achieving favorable shoulder function, as suboptimal HHH and NSA can cause pain and rotator cuff weakness, directly impairing joint function. Consequently, at the final follow-up, patients treated with n-HA/PA66 demonstrated statistically superior functional outcomes, as reflected by their DASH (25.5 ± 5.1 points) and ASES (78.9 ± 8.9 points) scores, compared to the PHILOS group, which had DASH (28.1 ± 4.7 points) and ASES (73.0 ± 10.3 points) scores. However, long-term observations revealed no significant differences in CMS or range of motion between the two groups. This discrepancy may be attributed to the inherent subjectivity of the DASH and ASES scores, which emphasize overall postoperative functional recovery and pain perception. In contrast, the CMS and range-of-motion assessments provide a more objective evaluation of local shoulder function.

Double-plate osteosynthesis, typically employing a lateral locking plate in conjunction with a ventrally placed one-third tubular plate, has emerged as a technique to enhance primary stability and facilitate anatomical reconstruction in humeral head fractures characterized by calcar region destruction, aiming to prevent secondary dislocation [26]. The supplementary steel plate stabilizes the medial column of the humerus, thereby preventing displacement during the reduction process [27]. Theopold et al. [28] published a small case series describing their technique using a lateral locking plate combined with an inverted one-third tubular plate placed in the bicipital groove, with a mean follow-up of 24 months. The average CMS was 80 points, but the incidence of AVN was 14.3%. Mara Warnhoff et al. [29] conducted a retrospective review of 31 patients who underwent double-plate internal fixation, with an average follow-up of 30.9 months. At final follow-up, the mean CMS was 77 points, the ASES score was 76 points, and the NSA was 135° ± 13°. However, the study reported an AVN complication rate of 9.7%. Our results indicate that, at final follow-up, patients with n-HA/PA66 implants demonstrated a CMS of 73.8 ± 8.1 and an NSA of 132.7° ± 13.8°. Humeral head necrosis occurred in one patient (3.7%). Although our findings align with previous studies regarding functional and radiological outcomes, a key consideration is the surgical technique. The use of supplementary plates requires more extensive dissection and exposure, potentially increasing the risk of vascular and nerve bundle injury, as well as humeral head necrosis.

While segmental fibular allograft augmentation, placed endosteally in conjunction with a lateral locking plate, is frequently suggested as a strategy for enhancing medial support in proximal humerus fractures [14], the evidence regarding its efficacy remains somewhat equivocal. Dasari et al. [30] synthesized data from ten observational studies encompassing 802 patients, reporting a 95% rate of improved radiographic outcomes, increased ASES clinical outcome scores, and reduced odds of major complications in patients treated with a PHILOS plate augmented with a fibular allograft compared with those treated with a locking compression plate alone. However, these findings are not universally supported. Lee et al. [31] demonstrated that locking plate fixation combined with a fibular strut allograft yields satisfactory short-term outcomes in terms of humeral head support and maintenance of reduction. However, in their study, the CMS scores of the two groups showed no statistically significant difference (83.5 ± 6.5 and 87.8 ± 5.6), both of which were higher than our results (73.8 ± 8.1 and 70.5 ± 6.8). One possible explanation is that satisfactory therapeutic outcomes in their study were achieved with locking plates alone, making the supportive role of the fibular strut allograft non-additive. Furthermore, a randomized controlled trial [32] concluded that fibular allograft augmentation provided no additional benefit in treating medial column comminuted proximal humeral fractures, either radiographically or functionally. Variations in these study results may be attributed to several factors, including patient age, fracture type, graft- and technique-related variables, and methodological differences in study design and evaluation.

Moreover, some researchers have explored the use of bone cement to augment the stability of the PHILOS plate in proximal humeral fractures, reporting promising clinical outcomes and reduced complication rates [33], but the body of research on this technique remains limited. Furthermore, the potential for cement-related thermal necrosis warrants continued consideration.

Research demonstrates that the mean operative time for two-part proximal humeral fractures typically ranges between 60 and 90 min [25, 34]. In contrast, several studies have reported that the average surgical duration for three- and four-part proximal humeral fractures extends from 110 to 130 min [35, 36]. A primary factor contributing to the prolonged operative time in more complex fractures is the increased difficulty in achieving effective temporary fixation. In the present study, a comparison of operative durations between two fixation techniques revealed that the n-HA/PA66 group experienced an average reduction of 25 min compared to the PHILOS group. Our experience suggests that incorporating n-HA/PA66 to support the humeral head, followed by K-wire insertion through the n-HA/PA66 construct (as shown in Fig. 4B), can enhance the overall stability of temporary fixation. The n-HA/PA66 effectively acts as a bridging scaffold, reducing the need for repeated K-wire insertions and maintaining fracture reduction. The PHILOS combined with the n-HA/PA66 augmentation provides surgeons with a more dependable and efficient solution for treating complex proximal humeral fractures. Extended operative time is associated with an increased risk of complications [28, 32, 35]. Although this study did not find a statistically significant difference in complication rates between the two groups, nor did the use of implants appear to increase the incidence of related complications, these findings may be influenced by the study’s limited sample size and relatively short follow-up duration.

Although n-HA/PA66 is recognized as a bioactive material [15,16,17], current evidence does not demonstrate osseointegration with the host bone. Theoretically, the potential for micromotion persists under extreme conditions. Moreover, as with all implantable devices, managing deep infections remains highly challenging once established. Extended follow-up periods are necessary to substantiate the long-term reliability of this material. It is recommended that quantitative CT analyses be employed to evaluate changes in bone density at the scaffold-bone interface, thereby enabling an objective assessment of the integration process. Furthermore, collaboration with biomechanical research laboratories is essential to systematically investigate n-HA/PA66 scaffolds with diverse geometrical configurations, porosities, and mechanical properties to determine experimental parameters that ensure sufficient load-bearing capacity. Existing research offers valuable frameworks for identifying optimal treatment strategies [37, 38]. Conducting a multicenter, prospective, randomized controlled trial comparing PHILOS combined with n-HA/PA66 scaffolds to PHILOS with autologous iliac crest bone grafts and PHILOS with allograft bone grafts would provide higher-level evidence to inform clinical practice.

Despite the need to acquire a comprehensive dataset encompassing both imaging and functional outcomes, this study is subject to several limitations. First, the retrospective design, which lacks randomization, inherently introduces the potential for selection bias and confounding variables. Second, while considerable effort was made to ensure appropriate patient selection, the statistical power of this single-center study remains relatively modest, potentially hindering the detection of subtle yet meaningful differences between the groups. Furthermore, a larger sample size is necessary to enable robust subgroup analyses. Third, the subjective nature of the DASH score may contribute to the discrepancies observed between it and the more objective CMS. Finally, the relatively short one-year follow-up period necessitates caution in drawing definitive conclusions regarding the long-term efficacy of the investigated treatment approach, suggesting the need for studies with extended follow-up durations.